GDP expected at 3.2% vs 4.2% target; reserves may hit $17.5bn by June; rupee stability urged

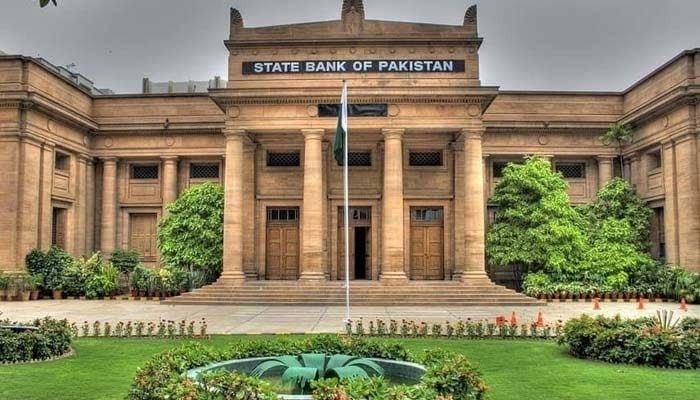

The State Bank of Pakistan (SBP) has projected that the country’s economy will expand by only 3.2% this fiscal year, falling short of the official growth target of 4.2%, as it flagged risks from inflation and exchange rate pressures.

Briefing the National Assembly Standing Committee on Finance on Tuesday, SBP Deputy Governor Dr. Inayat Hussain said foreign exchange reserves are likely to climb to $15.5 billion by December and $17.5 billion by June, assuming no external shocks. However, he cautioned against any artificial strengthening of the rupee, warning it would inflate the import bill and erode reserves. “The current exchange rate reflects the right value—neither overvalued nor undervalued,” he stated.

The committee meeting, chaired by Syed Naveed Qamar, discussed Pakistan’s economic outlook amid persistent macroeconomic challenges. Officials told the panel that inflation could exceed targets between April and June, driven by currency dynamics and global price volatility. The SBP also noted that the IMF permits a 1.2% value gap between the rupee and dollar under the current programme.

Responding to a query from PTI MNA Usama Mela, Dr. Inayat confirmed the central bank had purchased $7.8 billion from the market during the last fiscal year, including $720 million in July alone, but stressed interventions occur only when there is an excess supply of dollars.

Policy Questions & Criticism

Committee members raised concerns over inflation and interest rates, asking whether monetary easing should be considered ahead of the September 15 policy meeting. Over the past decade, Pakistan’s GDP growth has averaged just 3%, while remittances for FY26 are estimated at $40 billion. The government recently reinstated an incentive scheme offering 20 riyals per $200 remitted to encourage inflows after a decline.

Naveed Qamar slammed the Ministry of Industries and Production for skipping the session and failing to explain the carbon levy under the new EV policy, alleging that “parliament was misled even during the budget session.” The committee deferred the EV policy briefing.

CSR Bill Sparks Debate

The panel opposed the Corporate Social Responsibility (CSR) Bill 2025 proposed by the SECP, which seeks to mandate profit-making firms to allocate 1% of net profits to social causes. While Naveed Qamar backed making CSR contributions compulsory, Minister of State Bilal Azhar Kayani objected, terming it a “new tax.” Lawmakers including Hina Rabbani Khar, Mubeen Arif, and Dr Nafisa Shah urged a detailed review before the next meeting.

Tax in Ex-FATA

The committee also reviewed the 10% GST imposition in former FATA areas. Officials said two lobbies are pushing opposing agendas: one advocating industrial imports, the other resisting local taxation. FBR Chairman proposed compensating locals via BISP subsidies, given strong objections to taxing local consumption.