KARACHI: The Pakistan Medical Association (PMA) has expressed grave concern regarding a recent directive issued by the Federal Board of Revenue (FBR), Regional Tax Office, Faisalabad, targeting doctors, private clinics, and hospitals for aggressive tax enforcement and surveillance.

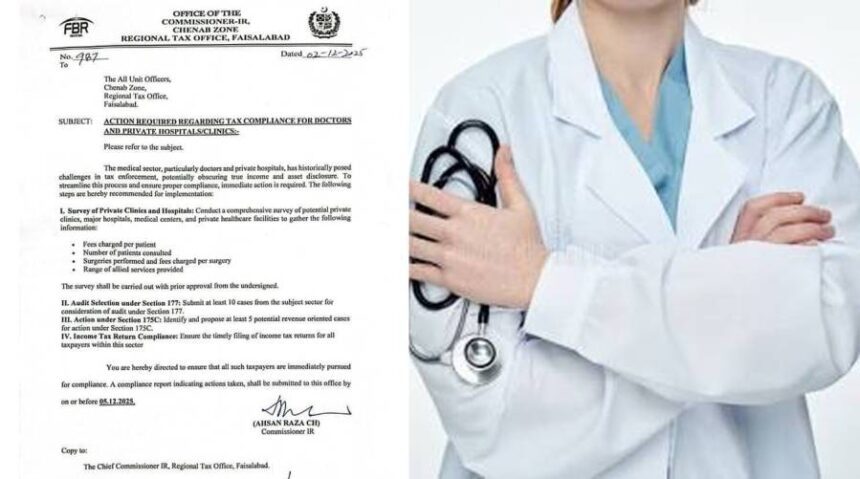

The FBR letter (Ref No. 987), dated December 2, 2025, describes the medical sector as “obscuring true income” and mandates immediate invasive actions, including detailed surveys of patient fees, surgery counts, and forced audits under Section 177 and Section 175C. The PMA views this move not as a step toward compliance, but as calculated harassment of the medical community.

Doctors are service providers, not traders

The PMA emphasized that doctors are essential service providers dedicated to saving lives, not commercial entities trading in commodities. Treating medical practice solely as a revenue-generating business ignores the humanitarian nature of the profession.

Public health at risk

Government hospitals and public healthcare facilities are insufficient to meet the needs of Pakistan’s growing population. The private sector, particularly family physicians, works under challenging conditions to provide healthcare at people’s doorsteps. The government’s aggressive approach risks reducing healthcare access for the general public.

Multiple tax burdens already exist

The PMA highlighted that the medical community is already heavily burdened with multiple financial obligations and remains compliant with the law. Practitioners already pay:

- Pakistan Medical & Dental Council (PMDC) licensing fees

- Provincial Healthcare Commission fees

- Excise taxes

- Sales tax on services

- Income tax (paid by a vast majority of doctors)

The association warned that the new FBR directive is redundant and only creates anxiety and unrest among doctors.

PMA demands

The Pakistan Medical Association strongly opposes the FBR decision and calls on the government to:

- Immediate withdrawal: Retract the aggressive surveys and audit directives targeting the medical sector.

- Cut government waste: Focus on reducing unnecessary government expenditures instead of pressuring essential service providers.